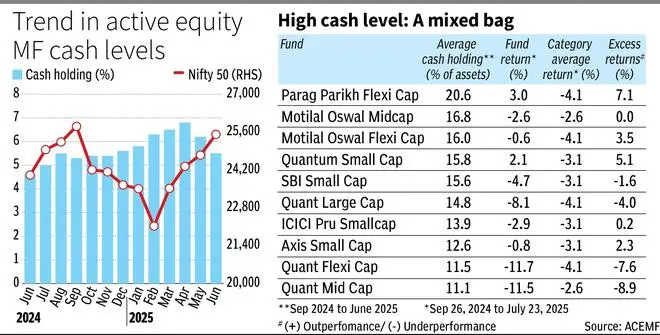

Cash holdings of actively managed equity-oriented mutual fund schemes declined to a seven-month low of 5.5 per cent in June, signalling a shift from the cautious stance seen earlier in the year.

Cash levels, which were at 4.6 per cent in June 2024, had steadily risen to a peak of 6.8 per cent in April 2025 as fund managers stayed defensive amid market uncertainty. Over the past two months, however, many fund houses have redeployed cash into equities.

In value terms, total cash holdings across 517 active equity mutual fund schemes fell from ₹2.1-lakh crore in April to ₹1.86-lakh crore by June 2025.

ACEMF data shows 51 per cent of these schemes cut cash exposure between April and June, while 46 per cent raised it and the rest held steady.

This shift came against the backdrop of a broader market recovery. From its peak in late September 2024 to early March 2025, Indian equities underwent a significant correction — Nifty 100 declined by 17 per cent, while the Nifty Midcap 150 and Nifty Smallcap 250 dropped by 21 per cent and 26 per cent, respectively. The markets have since staged a robust comeback, with the Nifty 100, Nifty Midcap 150 and Nifty Smallcap 250 delivering returns of 14 per cent, 21 per cent, and 25 per cent, respectively, from their lows.

Renewed optimism post-April, driven by cooling inflation, RBI rate cuts, and hopes of revival in corporate earnings, encouraged cash deployment. Funds like Motilal Oswal Flexi Cap (cash levels cut from ₹3,433 crore to ₹1,378 crore), Axis Large Cap (₹4,074 crore to ₹2,072 crore), and Parag Parikh Flexi Cap (₹23,448 crore to ₹21,493 crore) made large redeployments. Volatility also opened tactical opportunities in sectors like capital markets, electricals, transport, and defence.

Mixed outcomes

Cash serves as a cushion in falling markets and offers liquidity during corrections, but it is a double-edged sword. In volatile phases like the current one, cash-heavy portfolios often miss out on sharp V-shaped market recoveries.

Between September 2024 and March 2025, mostly funds with higher cash — such as Parag Parikh Flexi Cap (20 per cent, average over last one year), Parag Parikh ELSS Tax Saver (18 per cent) and HDFC Focused (13 per cent) — helped limit the downside.

However, in the recovery phase from March to July 2025, mostly low-cash funds outperformed. Motilal Oswal Large & Midcap (2 per cent average cash over last one year), Invesco India Midcap (1 per cent), DSP Small Cap (6.5 per cent), and Sundaram Small Cap (6 per cent) led the pack.

Over the full period (September 2024 to July 2025), some active and low-cash strategies fared better — Motilal Oswal Multi Cap dynamically adjusted its cash (between 3 and 21 per cent), while Invesco India Midcap and Invesco India Large & Mid Cap stayed low on cash and delivered strong returns.

Published on July 26, 2025