The funding trends in India were in stark contrast to global venture funding

| Photo Credit:

BL Net Mail

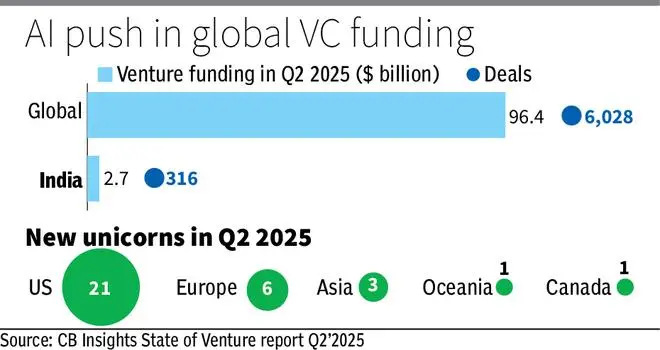

Indian venture capital investments made up just about three per cent of the global venture funding in April-June 2025 as the AI investment boom continues to be disproportionately confined to global markets, especially the US.

Indian venture capital firms invested $2.7 billion in equity funding across 316 deals in April-June 2025, as per data from CB Insights. This represented a decline of 13 per cent in both year-on-year (y-o-y) and quarter-on-quarter (QoQ) terms.

The funding trends in India were also in stark contrast to global venture funding in Q2 2025, which reached $94.6 billion in the quarter, the second-highest total since Q2 2022, and a growth of 34 per cent y-o-y.

Increasing investments in AI companies and more private capital appetite for hardware companies across tech and aerospace verticals boosted the global venture funding.

In an indication of the US’ position in the AI business ecosystem, the country held a bulk of the quarterly global venture funding at $68.7 billion across 2,430 deals. The disproportionate AI venture action is also visible by the number of new unicorns in the US in the April-June quarter.

Unicorns surge

Out of a total of 32 new unicorns globally in Q2, the US alone gave rise to 21 unicorns, while the whole of Asia only saw three new unicorns, CB Insights data shows.

Thinking Machines Lab (application and data integration firm), CHAOS Industries (aerospace parts manufacturing) and Kalshi (an asset and financial trading tech firm) are the top three new unicorns in terms of valuation, and are all from the US.

In terms of venture funding in India, 70 per cent of the Indian VC funding in January-June 2025 went into early-stages, mid-stage was 10 per cent, late-stage — 12 per cent and others — 7 per cent. The top deals of the quarter are those raised by logistics firm GreenLine, fintech firm Groww, and B2B commerce firm Jumbotail, data shows.

Besides the AI boom, hard tech investments captured six of the top 10 largest deals in Q2 2025 for $8.7 billion in total funding.

Notable deals include World View ($2.6 billion), Anduril ($2.5 billion), and Montera Infrastructure ($1.5 billion).

“The rise of hard tech represents a shift that is likely to define the next chapter of venture investing,” CB Insights said in its report. AI companies are raising larger, healthier, and more mature rounds [globally], it adds.

Published on July 15, 2025