This article has been updated to reflect the current new Series I bond rates for May, 2025 to November, 2025 period. The new I bond rate has been set at a composite 3.98% (up from 3.11% APR in the prior 6-month period). Due to a declining inflation rate, this current rate has dipped below the rate at the time I wrote my initial I bond overview a few years ago when I made my first purchase.

You can buy I Bonds online at the current 3.98% rate through the end of October, 2025 and you will get that rate for a 6-month period from the date of purchase. If, instead, you think there are better alternatives to keeping your money in I bonds, I’ve covered why it may be a good time to cash out I bonds with inflation and I bond rates dropping. Update: I’ve decided to sell 3 years worth of I bonds that I previously purchased. I detailed how to sell I bonds and the considerations to make before you sell.

I bonds had exploded in popularity in recent years as they are a very safe investment that have offered a strong guaranteed rate of return from the U.S. Treasury. Comparatively safe bank investments, meanwhile, were offering paltry interest rates until late 2022. That has changed, but there is no telling what the future holds. I bonds are designed to adjust to inflation rates.

What is the Newest Current I Bond Rate (Fixed and Variable)?

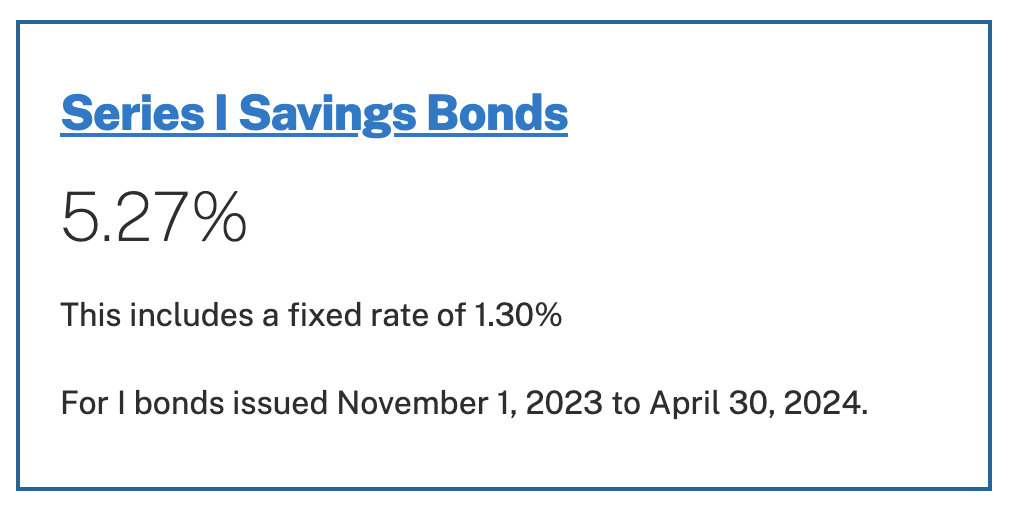

I bond interest rates are a combination of a fixed rate (which you get for the life of the bond) and a variable rate that changes every 6 months. Fixed and variable rates are announced every 6 months (on May 1 and November 1). The current I bond rate for bonds issues between May 1, 2025 and November 1, 2025 is 3.98%. This consists of a fixed rate of 1.10% and a variable rate of 2.86%. The next new rate will go into effect November 1, 2025.

How Long is the 2.86% Variable I Bond Rate Good For?

You receive the I bond variable rate for 6 months from the date of issue. Rates are compounded semiannually. For example, an I bond purchased in July of 2025 would get the 2.86% APR variable rate until January of 2026, at which point the variable rate would switch to the November, 2025 variable rate for the subsequent 6 months (in addition to the 1.10% fixed rate). The next variable rate change for that bond would be July, 2026, when the May, 2026 rate would kick in for 6 months.

Here’s a chart to help explain:

How Much I Bonds Can you Buy Per Calendar Year?

The amount of I bonds you can purchase in a calendar year depends on how you purchase them:

- Individuals (at Treasurydirect.gov): can buy $10,000 per calendar year, per account holder, in digital I bonds through the U.S. Department of Treasury at treasurydirect.gov. Individuals with a Social Security number can have 1 account each. Must be 18+ to buy.

- Living Trust (at Treasurydirect.gov): living trusts can purchase up to $10,000 per year through the name of the trust. This is definitely a more complicated option, but good to be aware of.

Note: up until January 1, 2025, taxpayers could also buy up to $5,000 per Social Security number in literal paper bonds through the IRS as a form of tax refund payment when submitting their tax return. This option is no longer available.

So, hypothetically, an individual could buy up to $10,000 per calendar year in digital I bonds, or a couple could buy up to $20,000 per year. Buying through a trust would open up an additional $10,000 per trust.

Is There an Early Withdrawal Penalty for I Bonds?

What if you need to access funds immediately, for whatever reason, or future I Bond rates go up and you want to cash out and buy new I Bonds? Here’s a breakdown:

- I bonds have a 30 year expiry from the date of purchase.

- I bonds must be held for a minimum of one year.

- If an issue is held for less than 5 years (but more than 1 year), the holder can cash in their issue, but will forfeit the most recent 3 months of interest returns as a penalty (the month of sale and 2 prior months).

Should I Invest in I Bonds?

I have invested in I bonds while their rates far exceeded the rates of comparable investments (e.g. money market accounts, CDs, savings deposits). With those rates having declined and comparable investments having increased, I’m now taking a wait-and-see approach to new I bond purchases. I’d like to see what happens with inflation and I bond and other interest rates. As always, do your research and make a decision for yourself, based on your own personal financial situation.