Images by Getty Images; Illustration by Bankrate

Key takeaways

- Federal student loans may be transferred to the Small Business Administration if Congress gets on board with President Donald Trump’s order to shut down the Department of Education.

- Student loan terms will stay the same, for now.

- The transitions could cause delays, disruption and service issues, so borrowers should prepare and stay vigilant.

On March 20, 2025, President Donald Trump issued an executive order calling for the shutdown of the U.S. Department of Education. Since then, he has announced that federal student loans will be administered by the Small Business Administration (SBA).

This unprecedented move raises many questions about the future of federal student loans and what it means for borrowers. Some social media speculators even mistakenly claim these changes are a sale of the loan portfolio that will make student loans uncollectable.

U.S. Secretary of Education Linda McMahon pledged that the Trump administration will “continue to support … college student borrowers” after closing the U.S. Department of Education.

But major transitions often come with disruptions, and student loan borrowers should stay alert.

Moving federal student loans to the SBA

During a March 21, 2025 press briefing in the Oval Office, President Trump stated his intention to move the $1.6 trillion federal student loan portfolio from the U.S. Department of Education to the Small Business Administration “immediately.”

At the same time, the SBA staff is being cut by 43 percent, raising concerns about its ability to manage a loan program of this scale. They will be expected to do more with less.

Legally, moving federal student loans to another federal agency will require an act of Congress. Under 20 USC 1018, the Higher Education Act of 1965 specifies that the U.S. Department of Education’s Office of Federal Student Aid (FSA) is responsible for administering all Title IV federal student aid programs, including federal student loans.

Keep in mind: While oversight might shift, ownership of the loans remains with the federal government. This is not a sale of the loan portfolio.

The SBA, primarily focused on supporting small businesses, lacks experience with student loans. Its current guaranteed loan portfolio for small businesses is less than one-twentieth the size of the federal student loan portfolio and serves fewer than 1 percent of the number of borrowers.

Servicing and oversight may shift

If responsibility for federal loans moves to another agency, day-to-day servicing (e.g., billing, customer service and autopay) may remain the same. Loan servicers are expected to continue their existing roles, although oversight would shift from the U.S. Department of Education to SBA.

So, if the transition goes smoothly, the impact on borrowers may be minimal.

What might change:

- Call center support, such as the Federal Student Aid Information Center (FSAIC), could be scaled down, especially if staffing is reduced. This may lead to longer call center wait times and more dropped calls.

- A proposal to replace human staff with AI may lead to diminished service quality.

- Applications for forgiveness programs like Public Service Loan Forgiveness (PSLF) and Borrower Defense to Repayment could face processing delays.

Risks of disruption during transition

A 50 percent staff reduction at the U.S. Department of Education, combined with an uncertain transition plan, poses real risks. It is unclear whether FSA staff will be transferred to the SBA. There may be delays and disruption, affecting the stability of the federal student aid programs.

Potential impacts include:

- Errors or delays when switching loan servicers, such as the loss of detailed loan information.

- Slower implementation of policy updates and repayment options.

- Errors or delays in Free Application for Federal Student Aid processing and financial aid offers.

- Longer processing times for loan consolidation and loan forgiveness applications.

- Delays in switching student loan repayment plans.

A push toward privatization?

The executive order hints at a broader effort to privatize federal student loans. The president compared FSA to major financial institutions, arguing that the U.S. Department of Education is not equipped to function like a bank.

“The Department of Education currently manages a student loan debt portfolio of more than $1.6 trillion. This means the Federal student aid program is roughly the size of one of the Nation’s largest banks, Wells Fargo. But although Wells Fargo has more than 200,000 employees, the Department of Education has fewer than 1,500 in its Office of Federal Student Aid. The Department of Education is not a bank, and it must return bank functions to an entity equipped to serve America’s students.”— Donald Trump, U.S. President

Reinstating a guaranteed student loan program like the Federal Family Education Loan Program (FFELP), which ended in 2010, would also require Congressional approval. But, today’s loan volume is double what it was under FFELP and private lenders may not have the capital or willingness to support such a program.

Selling the federal loan portfolio is also unlikely. Under 20 USC 1087i, the Higher Education Act of 1965 requires that any sale result in no net cost to the government — a tall order, given the size of the portfolio and the lack of sufficient liquidity in private markets.

What won’t change: Student loan terms

The terms of your federal student loans are specified by the Master Promissory Note (MPN) that you signed when you borrowed the loans. These include the interest rate, loan fees, repayment options, deferments, forbearances, discharge and forgiveness provisions.

Keep in mind: These terms cannot be changed unilaterally by the government, even if the overseeing agency changes.

What borrowers should do now

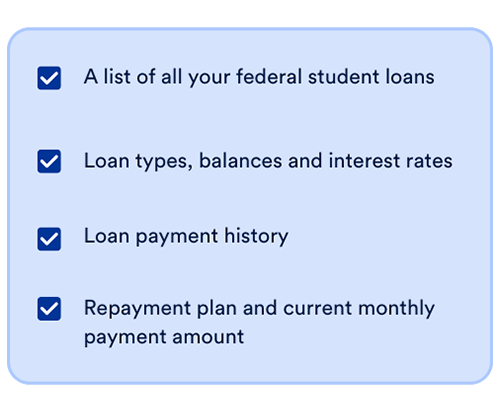

To prepare for possible changes or disruptions to federal student loan programs, download and save your full loan details from StudentAid.gov and your loan servicer’s site, including:

Borrowers should also take screenshots as backup documentation.

If you are signed up for autopay, you may need to sign up again after a change in loan servicer. In the meantime, make manual payments to avoid missed deadlines.

And lastly, watch out for scams. During times of uncertainty, misinformation spreads easily. Social media claims on platforms such as TikTok and Tumblr that student loans are automatically canceled or unenforceable are false.